"You don't change Bitcoin, Bitcoin changes you."

This is just one of the many mantras that are being repeated frequently inside the Bitcoin community. I am now two years distant from the beginning of my experience with Bitcoin, and I am able to personally attest to the legitimacy of the aforementioned statement. Even if my involvement with Bitcoin has been limited to a very short period of time, a lot can change in only two years, particularly for persons in their early 20s. Anyone who participates in the Bitcoin adventure will, in due time, find that they have embraced the four cardinal virtues. This is because Bitcoin is a never-ending quest for knowledge.

The four cardinal virtues are a basis of moral guidance that may be found in many religions and philosophical traditions, including Christianity, and were popularized by philosophers such as Plato and Aristotle. The qualities include wisdom, temperance, justice and fortitude. Because all other virtues depend on the four cardinal virtues, they were given the name "cardinal" from the Latin word "cardo," which means "hinge," as in: all other virtues hinge (rely) upon the cardinal virtues.

I have described how everyone who is sincere in their pursuit of the Bitcoin mission to divide money and state is strongly encouraged to conduct in accordance with the cardinal virtues.

The Use of Bitcoin Encourages Caution

exhibiting a concern and care for the future via one's actions or behavior.

When you first hear about Bitcoin, you will not have any comprehension of what it actually is. Even after the second, third, or fourth reading, you won't have a good grasp on the material. Few people in today's fast-paced world have put in the hours necessary to acquire a thorough understanding of how the technical aspects of Bitcoin function. Even fewer people who have used Bitcoin have invested the time and effort to study all of the disciplines that are relevant to the cryptocurrency. These disciplines include, but are not limited to, economics, personal finance, computer science, energy markets, the history of money, and geopolitical game theory.

It would be an understatement to claim that Bitcoin will have a significant influence on the entire planet. Prudence is required if one is to begin with even the most fundamental comprehension of what the impact will be. To paraphrase what Michael Saylor had to say about it, "there are no informed critiques." Those who quickly label Bitcoin as a Ponzi scheme, on par with those run by Bernie Madoff or Sam Bankman-Fried, are merely demonstrating their intellectual laziness.

The topic of time preference is one that is frequently discussed among Bitcoin enthusiasts and was made popular by Austrian economists such as Saifedean Ammous. If you have a low time preference, it indicates that you are willing to prioritize your long-term well-being over your immediate well-being; this is the very essence of the virtue of prudence. People who engage in the speculative markets of altcoins or attempt to trade bitcoin's unexpected short-term volatility rather than HODL the asset with the least amount of uncertainty overall are naturally unwise. HODL is the asset with the least amount of uncertainty in history.

You have demonstrated wisdom by putting in the hours required to have a deep understanding of Bitcoin's technological principles and its larger consequences on society.

Bitcoin instills a sense of moderation.

A consistent level of self-control when it comes to indulging one's cravings or urges.

Bitcoin users attain moderation through low time preference behavior, which is analogous to the virtue of prudence.

There are not a lot of whales in Bitcoin looking to sell their positions in order to make a profit in terms of fiat currency, despite the widespread misinformation that is spread by non-coiners. Moreover, because the number of people using Bitcoin is growing at an exponential rate, coupled with the fact that only a finite amount of it will ever be produced, each new wave of users quickly comes to the conclusion that it is in their best interest to accumulate as many bitcoins as they can before the rest of the world catches on.

When bitcoin becomes your individual unit of account, you will start considering the opportunity cost of collecting more bitcoin whenever you consider making a possible transaction or going through an event. This has resulted in many Bitcoiners, including myself, adopting lifestyles that are more simple as a result. The most important takeaway from this is that the decline of materialistic items in search of more bitcoin, which was possibly first driven by the desire to satisfy future avarice, brings forth the knowledge that having a lot of material goods is not necessary.

You are embracing the cardinal virtue of temperance when you restrict yourself to "needs" rather than "wants" in your personal budget in order to save wealth in bitcoin. By doing so, you are moderating the degree to which you indulge your appetites or passions, which is another way of saying that you are limiting the extent to which you indulge your appetites or passions.

Bitcoin inspires a sense of justice.

Fair dealing or behavior; giving each person what is rightfully or justly owed to them.

The fiat monetary system is the greatest financial con job in the history of the world. Central banks have been there for far too long, and as a result, governments have had the power to fund the goals of the ruling class at the expense of monetary savings and future economic development. This has been the case for far too long. Prior to the recent dramatic acceleration of inflation that has been taking place over the past couple of years, the majority of people living in Western nations were fully oblivious of the backdoor robbery that occurs as a result of an increase in the amount of money in circulation.

Everyone who uses Bitcoin receives unalienable property rights in the cryptocurrency. The value of each unit in the network cannot be diluted by any government agency or private firm, and it is extremely difficult, if not impossible, to seize bitcoins that have been stored appropriately. Bitcoin is a decentralized digital currency that operates on an open and impartial network that does not discriminate on the basis of religion, ethnicity, sexual orientation, race, or vaccination status. No one is prevented from operating a node in order to verify the legitimacy of each transaction that is recorded on the ledger.

Bitcoin is the most equitable asset and monetary network in the history of mankind because it guarantees irrefutable access to an unconfiscatable and undilutable form of property. This makes Bitcoin the most just asset and monetary network.

Bitcoin instills a sense of perseverance.

The ability to muster bravery in the face of suffering or difficulty.

Bitcoin users hone their resilience in two different ways.

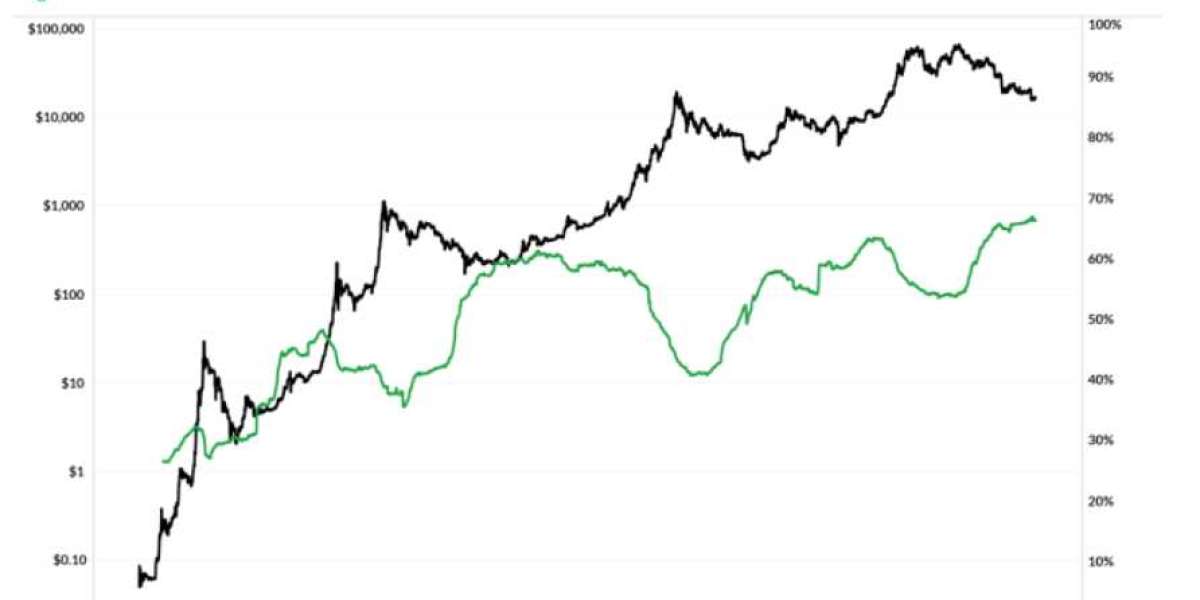

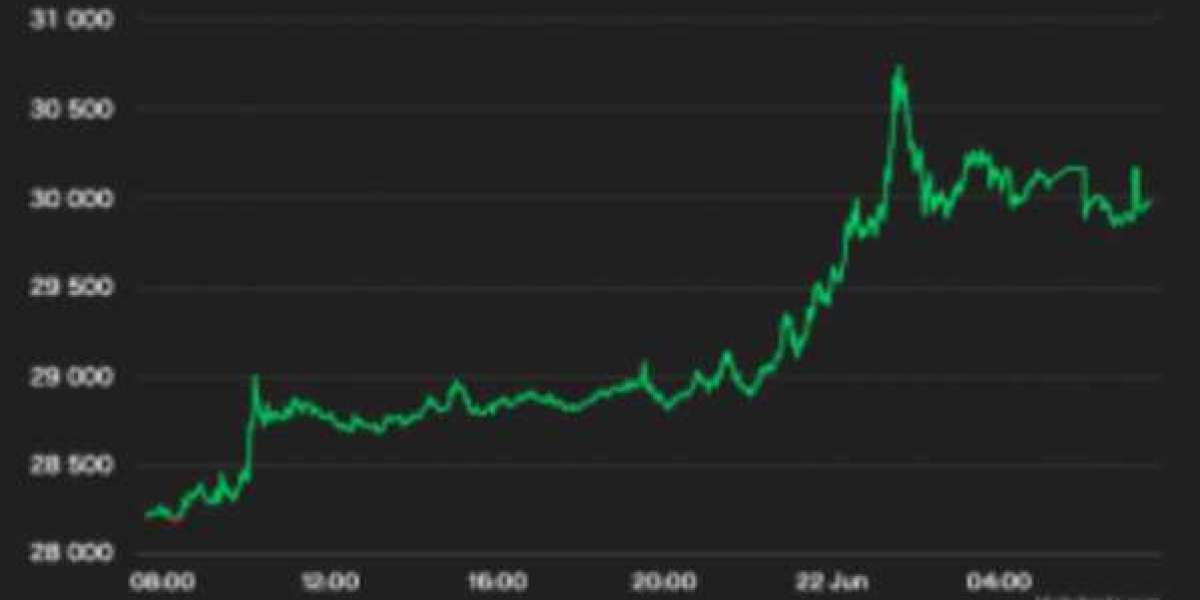

The first method is to encourage HODLing by maintaining volatility in the market. Since its all-time high, the price of bitcoin has fallen by more than 70 percent as of the time this article was written. This is the fourth time in Bitcoin's history that we have experienced a drop of this magnitude. Bitcoin has been around for thirteen years. The data that is stored on the Bitcoin blockchain demonstrates that Bitcoin users are showing remarkable bravery in the face of this challenge. An all-time high of nearly 66% of Bitcoin's supply has not moved in one year or longer, and this stagnation has been going on for quite some time. This tenacity is not unprecedented either, since this statistic has set all-time highs during prior bear markets as well. This shows that investors are resilient even under adverse market conditions.

It seems as though a virtuous cycle of positive feedback is operating here. When one is able to observe for themselves that other bitcoin holders are unfazed by the huge drawdowns in price, it encourages one to grow more confident in the future of the network, and it enables one to continue HODLing themselves as a result.

The second method that Bitcoin users can grow their fortitude is by persuading other Bitcoin users to do an action that is analogous to the one that the founding fathers took when they signed the Declaration of Independence. Even if possessing bitcoin is not outright prohibited in most nations, doing so will not place you in a good position with the most powerful entities in the world.

It has been demonstrated throughout history that governments who now hold the position of controlling the global reserve currency do not take well to having that position hijacked. As a consequence of this, there is a probability that those who use Bitcoin will be labeled as traitors in the event that the federal government of the United States makes a spectacular, last-ditch effort to keep control over the monetary system.

As the Chief Executive Officer of Swan Bitcoin, Cory Klippsten, explains so eloquently in this piece, this extreme can be avoided if Bitcoin is successful in gaining widespread use.